A well-developed, diverse portfolio is key to the long-term growth of your investments. It protects your assets from future dips and possible structural changes in the economy.

The first thing you need to do is to determine how you want to allocate your assets in conformity to your investment goals. Study closely your current financial situation, keeping mind your expected future capital needs, and your risk tolerance. All investments involve risks and patience, and some investors give up too quickly when the market falters. Know that declines are normal.

|

Image Source: freeinvestmentguides.com

|

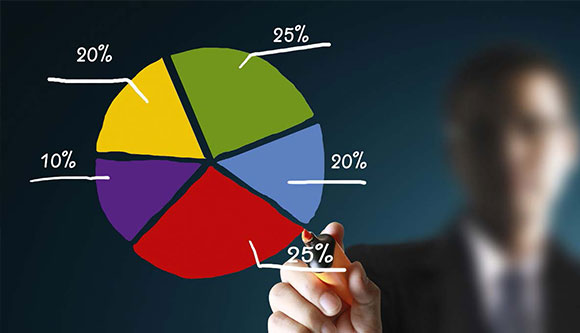

Next, study how you will divide your capital among your various assets. Spend time picking stocks, mutual funds, equities, and particular sectors that you’ve found to be most lucrative. Remember that this process is crucial to the portfolio and investment in general. This can get complicated without the help of a financial advisor, so consider getting one at this point.

By this time, your portfolio will have been done. But understand that periodical rebalancing and reassessment are important. This is because as the market fluctuates, so will the value you’ve initially given to particular assets. Adjust your portfolio allocations accordingly, then proceed to sell securities that are now overvalued and buy underweighted ones.

Lastly, take a moment to consider the tax implications of your readjustments. Discuss with analysts and advisors to better estimate the outlook for your holdings, since sometimes tax-loss selling is a needed strategy to reduce projected tax.

|

Image Source: moneysense.com.ph

|

Springer Financial Advisors stands out in the financial planning industry with its holistic approach and a dedicated team of advisers who don’t just ask about a client’s financial goals, but give more thought to their life goals. For more sound investment options, visit this blog.